There are currently 170 superannuation funds in Australia managing the bulk of the $3.1 trillion in retirement savings for Australians (Source: APRA Statistics, March quarter 2021). Recently, Helen Rowell, deputy chairwoman of APRA said in a speech to the Australian Institute of Superannuation Trustees that “Larger funds are better placed to deliver stronger investment performance and lower fees,” with scale an increasingly important determinant of “member outcomes.” Ms. Rowell went on to say that “smaller, underperforming funds would ideally consider merging with a larger, better performing partner rather than another small fund — especially one that is also underperforming.”

Recently passed legislation forces funds to be more transparent with members regarding performance. APRA will also maintain a public register to ‘name and shame’ under performing funds. In extreme cases, APRA will prevent underperforming funds from accepting new members. This, along with continual incremental increases in compliance reporting and requirements will likely both accelerate interest in fund consolidations while also increasing the complexity for execution.

It will therefore be critical for these mergers to be run effectively in the best interests of members, as unnecessary cost will be passed on to the members through their administration fees.

This article discusses some of the key considerations involved in merging superannuation funds and provides an approach framework.

Tangible benefits of a merger between two superannuation funds generally include:

- Reducing costs associated with member administration and overall fund operating costs

- Improving value via lower cost or more comprehensive, or specialised insurance

- Improving investment outcomes through scale and reduction in management fees

- Improving member services and engagement opportunities

In addition to the tangible benefits, a merger between superannuation funds could also result in some of the following strategic or intangible benefits:

- Delivering the scale required for access to certain types of investment opportunity

- Obtaining exposure to new member cohorts (i.e. age, industry, occupation)

- Expanding the geographic area in which the fund operates

- Expanding the breadth of skills available to the fund by combining executive teams and boards

- Broadening the range of products available to members

- Diversifying exposure to defined benefit schemes

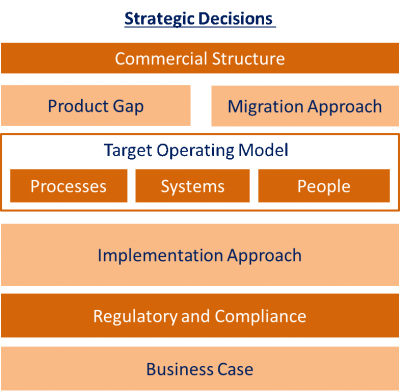

There will be several strategic decisions, as illustrated in the diagram below, that will influence the superannuation fund merger and will need to be decided up front.

A brief discussion of the key strategic decisions is provided below including the sorts of questions you will need to answer during due diligence and planning:

- Commercial structure – Will it be a:

- Joint venture between the two funds to pool investments and combine backend operations, maintaining separate governance and compliance obligations but maintaining both brands in the market.

- Acquisition (aka Successor Fund Transfer) where one fund absorbs the other fund effectively adding to the Funds Under Management and member base with only the acquiring fund’s brand being maintained in the market, or

- Merger where both funds pool investments and combine backend operations but only one set of governance and compliance obligations exist in the merged entity whilst maintaining both brands in the market.

- Product gap – what is the difference in the products of the funds being merged? This covers accumulation investment options, pension income stream investment options and insurance options (life, TPD and income protection).

- Migration approach – what migration approach will you use? Will you use an SFT (Successor Fund Transfer) approach? Will you use an outsourced superannuation fund administrator to perform the migration?

- Target operating model (which is comprised of Processes, Systems, People, Data)

- Processes – what does the target process model look like? Are there many new processes required?

- Systems – what does the target systems architecture look like? How many new interfaces are required? How much additional infrastructure is required?

- People – what does the target organisation structure look like? Are there any impacts other than in operations?

- Data – how much historical data will be migrated across? How will it be used to service members?

- Implementation approach – should you implement by fund, by product, by geography, by adviser group etc? Should you do a big bang implementation or is this too much of an impact to BAU (Business As Usual)? How many people need to be trained and when? What will be the business outage window?

- Regulatory and compliance – obtain trustee approval to the merger. Obtain APRA approval to the merger. Consider significant event notices to members and their timing, updates to PDSs, inform other impacted parties including, employees, employers, payroll providers, gateways, Superstream, external auditors, the ATO

- Business case (Members’ best interests test) – determine migration cost, determine target operating costs and then confirm if the business case makes sense.

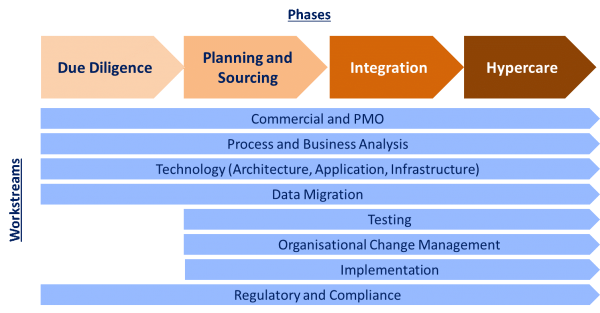

Seven Consulting’s approach for super fund mergers is illustrated in the diagram below:

We recommend that the merger program be divided into 4 phases:

- Due diligence – do enough analysis to determine if the deal is viable, has a valid business case and is in principle, agreed by all key parties including the regulator.

- Planning and sourcing – confirm all the scoping and planning assumptions. Prepare a detailed estimate and plan of the migration program. Negotiate with key

- Integration – undertake the migration program including designing the target operating model and building the data migration processes. Plan and practise the

- Hypercare – once the initial migration has occurred, manage all the issues/defects/risks that come up until business operations returns to an acceptable level of exceptions.

As a starting proposition to be reviewed by scenario, we recommend breaking up the merger program into 8 workstreams which span the various phases:

- Commercial and PMO stream – which manages the deal, the integration program and

- Process and business analysis stream – which specifies all product gaps, process gaps, reporting gaps and member collateral/correspondence

- Technology stream – which manages the design/build/test of any changes required to the technology solution including online portals, interfaces, core registry, other

- Data migration stream – which manages the design/build/test of the data migration of members, employers, accounts, balances, inflight

- Testing stream – which manages the test preparation and execution of integration testing, end-to-end testing, user acceptance testing and performance

- Organisational change management stream – which determines the organisational change impacts, prepares the training materials, delivers the training, manages stakeholder and employee

- Implementation stream – which prepare detailed business implementation plans and runsheets, manages dress rehearsals, prepares go/no go checklists, monitors go/no go readiness prior to implementation, manages implementation weekend

- Regulatory, compliance and communications stream – manage relationships with regulators (e.g. APRA), ensure fund compliance, communicates SENs to members, updates PDSs.

In conclusion, we expect the level of superannuation fund merger activity to increase as funds consider their performance and sustainability compared with the rest of the industry. Undertaking a super fund merger and the way it is executed is a key consideration for trustee boards and executive teams and requires careful planning across a range of dimensions.